Doctor’s networks – an emerging engagement channel

pharmafile | November 29, 2010 | Feature | Medical Communications, Sales and Marketing | Len Starnes, PatientsLikeMe, doctors' social networks, social media, social networking

The last four years have seen an extraordinary growth in physicians’ social networks and a rapid increase in levels of activity and interest.

I’ve been tracking them since day one, and have worked with many of the networks on a variety of projects.

These networks reflect the great influence the internet age is having on medical practice.

Research suggests that regardless of cultural differences, doctors around the world now view the internet as essential to how they practice. And around a fifth can be identified as highly ‘e-reliant’. One of the measures of this is where they get their clinical information, and more than 75% are saying they are getting that information online.

One of the key developments for the industry came in October 2007, when Pfizer announced a strategic partnership with US social network Sermo. Pfizer said the alliance was part of its commitment to engage in “peer-to-peer medical dialogue with physicians” to meet the mutual goal of helping patients. Jeffrey Kindler, the chief executive of Pfizer indicated that it wanted to put the ‘hard sell’ tactics behind it, as this is not what doctors wanted – instead it would try and build ‘a more open and honest’ discussion.

I was part of a group of pharma people who were invited by Sermo to a Japanese restaurant in Princeton in the week following the Pfizer deal. They walked us through everything they were doing, and their vision of the future, and this certainly caused quite a stir in the industry.

There are some who question the motives behind Pfizer’s move. Following the news, John Mack’s Pharma Marketing Blog carried a satirical cartoon depicting Pfizer as a predatory cat and Sermo and its online doctors as a bowl of goldfish. Its paws wrapped around the bowl, the cat says: “I for one am glad we can have an open dialogue.”

Whatever your view, the Pfizer/Sermo partnership represents a major shift in how medical information is exchanged, and this quite rightly caused a stir when it was first announced.

So that was October 2007, but where are we today? In those three years, the US has seen a proliferation of physicians’ networks. In terms of their number, diversity, success in raising venture capital funding and pharma participation, the US ones are still probably setting the pace, but less so than a few years ago.

The two largest US-based networks are Sermo and WebMD/Medscape. They both have around 112,000 members each – that is a lot of members. But there is a significant ‘long tail’, comprising many much smaller players, some of whom focus on specialities, such as radiology. One well known one is ‘Spine Connect’ which has a membership of only 2,000 members, but they are all spinal surgeons, and they are all very happy to talk to each other. Some specialise in other types of service; Ozmosis is one in which identities are fully revealed, similar to the general business sites like LinkedIn or Xing, where you know exactly with whom you are speaking. Europe’s networks are catching up with the US ones, although they remain somewhat heterogeneous and fragmented. The UK and Germany are certainly leading in terms of the numbers of networks, but there are fewer players than in the US.

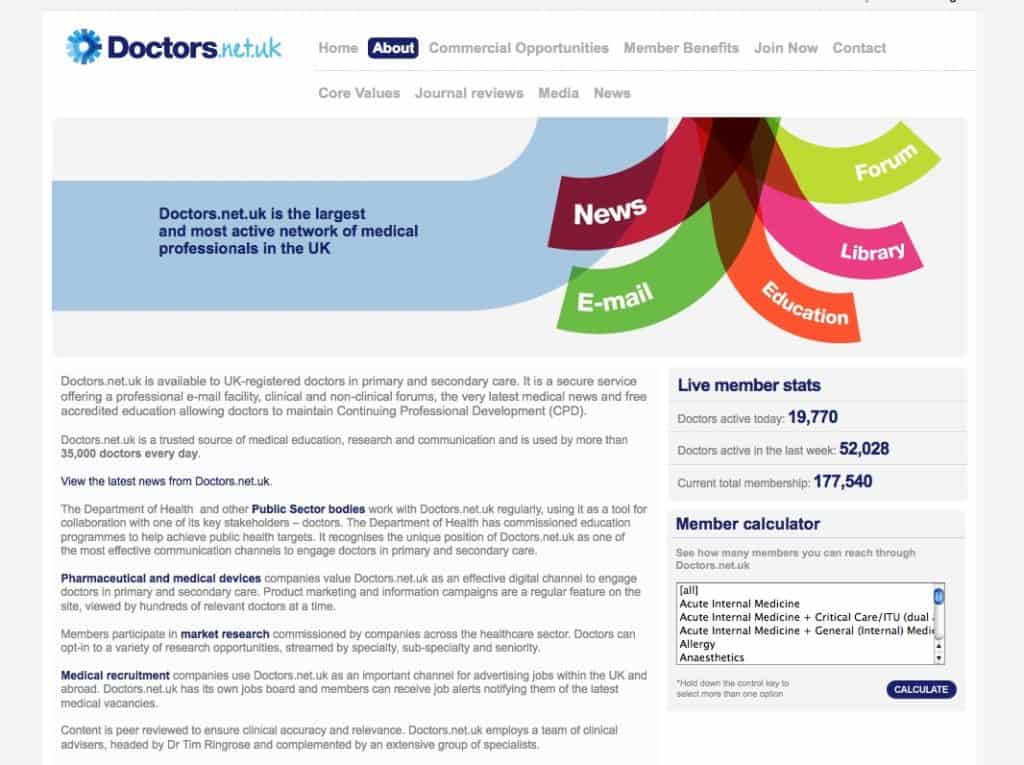

The newest European network is called MedUniverse, it is based in Stockholm, and aims to serve all of the Scandinavian countries (UK-based Doctors.net.uk recently acquired a stake in MedUniverse). Another example is the BMJ’s Doc2Doc. This is a global network, which currently has members from 130 countries, and its aim is to integrate the network with BMJ group content, such as the eBMJ.

In the German speaking countries, there is a very dynamic network, called Coliquio, which has around 16,000 members. It recently launched a partnership with the leading German medical journal the Ärzte Zeitung, and is expanding quite significantly in 2010.

Asia Pacific growing fastest

However it is in the Asia Pacific region where the greatest action is taking place – we are seeing extraordinary growth rates and really significant membership numbers.

In China the proliferation of networks is quite extraordinary, there are far too many to list. I have been focusing quite a lot on Asia in recent months.

www.Dxy.cn is the largest Chinese network, it flags up 1.7 million members – putting that in context, there are 2.1 million healthcare professionals in China. There is no authentication, however, which is a significant downside. Nevertheless, the site says 50% of its members are doctors, and 30% are biomedical researchers and 20% are medical students. There is tremendous activity on this website – it is run by an ex-Bayer employee, and I am just amazed at what happens on there.

The most notable of Japan’s networks is www.m3.com. I am currently working with this network – it has 177,000 members – and there are huge amounts of activity on the site. South Korea has Medigate, which has 67,000 members. In India there are a tremendous number of networks, but the biggest difference there is that they don’t authenticate the people applying.

Understanding the different types of doctors’ networks

So how do you start to order and understand all these different sites? Two of the most important criteria are whether they authenticate users and whether or not pharma is allowed to participate.

Membership is authenticated and they offer partnership options for the industry. Some of these networks are for all specialities, and some just focus on one or two. Those are the ones that we should be looking at. Some authenticate, but they exclude pharma – there are networks in Canada, for example, which specifically do not want pharma to participate.

The other ones are where they don’t authenticate users at all, so frankly you don’t know who is in there. These networks are not of interest to the medical profession, because doctors are simply not prepared to open up and discuss professional issues if they even suspect that patients are listening in. The second dimension taxonomy is becoming important. Sermo started off as what I call pure play – a social network only – like LinkedIn or Xing.

The hybrid models that are now emerging mix the social network with an online medical resource, of various types. I believe these networks will be of most value to doctors, because if you can combine networking with content, services and tools that related to a doctor’s daily practices, then they will congregate there. And a lot of these models are beginning to emerge.

From market research to active engagement

So what can we as an industry actually do with these networks? The partnering models come in many shapes and sizes, but they boil down to three things:

1) Observation

Basically this is passive market research. You go in and you see what a community is talking about, and you can observe all these things.

2) Active market research

You go in and ask a specific question. You can select a cohort. I have done this many times. Typically my polls run a week, and I get the answers back within that time, I might pay doctors maybe $10, and my cohort is up to 100-200 doctors. It is tremendously efficient and very fast way to get feedback on anything you care to ask.

3) Engagement

This is really where a lot of pharma companies are moving into. This is where we send in our own medics and medical liaison people to engage with a community. The community must be aware at all times of pharma moving in, so they are flagged up, stating my name and that I am from the industry.

This gives our medical liaison a chance to talk to doctors directly. Doctors can ask our reps direct questions. We have the opportunity to post information and services that is germane to discussions. This is a new development and this is where the channel becomes extremely valuable.

So what have we learnt?

These are some of the top line features:

Membership is growing everywhere. For instance in the US in 2008, we asked doctors are you using networks – and 60% said they were.

This jumped up to 71%, a very significant growth, about 19% or so.

In Europe, we are seeing the same types of growth. Coliquio.de started out in 2007, it now has a membership of more than 30,000. The number of posts and activities is also increasingly rapidly.

Doctors.net.uk is the UK’s largest network, and they have a dedicated area for oncologists, and they registered an 18% increase in sessions.

You might say, this is all very well, but isn’t this is only of interest to younger physicians? The answer is absolutely not. On Sermo, the most active group is the 50-59 age group. The market research suggests that this group are very experienced, they have a lot to say, and they like sharing information. They also happen to have some the largest patient practices and some of the largest prescribers, so they are of particular interest to the industry.

We see exactly the same phenomenon in Coliquio. The largest and most active group is the 50-59 age group, and we are seeing this pattern right across the globe.

There are a few provisos. Doctors generally welcome pharma’s participation – I have carried out some market research on this myself – but they have to know exactly when and how pharma is participating, and they specifically do not want hard selling or advertising, that is strictly taboo.

Some of the market research from the US physicians found that nearly 60% agreed to pharma involvement, and those numbers have crept up over the last two years.

What are the specialities that are particularly interested in interacting with pharma? Oncologists are among those that are most interested in interacting. What do they really want? I have been talking to a lot of the networks. I had Joel Selzer, the chief executive of Ozmosis come and visit me at Bayer’s HQ, and he says doctors want fast, simple, reliable answers to product questions. And when he said ‘fast’ he meant ‘instant’ – we are living in an age where people expect things right away.

This is not a medium or a channel where if a doctor asks us a question, there is no point us going away for a week and then answering the query in PR speak. If that is the way you want to engage doctors, forget it. You have to empower your medical people to give those answers honestly, openly and right away.

They do value direct peer-to-peer engagement, and trusted feedback. So the people that you send in to these situations have got to understand the rules of engagement and understand when and how to be open and honest – and that is very tough to do.

They do like to have the rep-like services built into the network, the tools, the content and the services directly accessible through that network, so it is a place to contact pharma and use the services.

So what are the challenges that we face entering this kind of network? They are quite considerable. One of them is really about functional collaboration, if the initiative like this is driven by the sales department, then we are going to have to work very closely in a way that we have never done before, with medical and scientific, and inevitably legal and regulatory.

I am right in the middle of discussing many of these types of projects with these groups. It’s not easy, because we have never done this before, so when I say to my medical people, and say I want you to go into these networks, they have no idea what I am talking about. When I talk to my legal and regulatory people, they have no idea either, because we have never encountered anything like this before.

It takes a great deal of effort to explain this and create some ground rules. You may not have fixed ground rules, you might have guidelines, but the way we engage may be different on each individual network, so you may need guidelines rather than hard rules.

Last year, when I was analysing networks, I wondered if I had lost touch with reality, or allowed hype to overwhelm my thinking, so I posted a question on my LinkedIn page to well over 500 members. Within about five minutes I got a call from central Singapore, and my telephone and email didn’t stop for two days!

I asked: ‘Will doctors’ networks radically change pharma marketing and sales?’ Eighty per cent of my network said it will within the next 10 years, and the majority of those said within the next five years. So I felt reassured that I wasn’t just giving in to hype!

Predominance of e-savvy physicians

So what might all of this mean for the future? The first clear point is the predominance of e-savvy physicians. Most doctors practising today say that the internet is essential to their practice, but doctors who are just graduating will inevitably take the technology much further.

These current student doctors are all on Facebook, and Flickr, and they will expect to use these social networks in their professional networks.

Meanwhile a lot of the baby boomers will be retiring over the next few years. So we will see routine use of social networks among the majority of doctors, and they will expect to engage with pharma on these social networks. They will also expect a very rapid ‘e-self service’. They are looking for answers, and they don’t want them next week, they want them now. We will have to think about how we provide this e-self service – the content, functionality and so on.

I think there will be a further dwindling of salesforce numbers; they won’t disappear, because face-to-face contact will remain important, but we will see a growing number of doctors who don’t want that salesforce contact. So we will see the emergence of multi-channel engagement models, and we will have to think about what kind of multi-channel models we mean, and the role of sales within those models.

So I think there will be an inevitable shift, from less selling with fewer sales reps, towards more open and honest dialogue; but I’m not sure what ‘open and honest’ means yet – that is something that that we are discussing intensely in the industry.

I also believe we will see many more multi-disciplinary engagement teams – I have already set some of these up in my own company. We are grappling with the issues that they really pose – it’s not easy but I think we will have to inevitably move in that direction.

I am not pushing technology at all, I am pushing relationships. The technology for me is secondary. We are analysing where the doctors are going.

To coin a phrase, you have to fish where the fish are, rather than hope that they come to you. The alternative is trying to build up the audience for your own websites. Many companies build corporate websites, but do we know the value of those websites? Do we know what they mean for the business? Most of us don’t.

So I think that means that where we are spending on digital, we are spending in the wrong way. Those branded websites are, for me, not where we should be investing. Look instead at where doctors are going, how they are engaging with their peers, and where the KOLs are going, and then adapt your digital strategies or tactics.

I look with brand teams to see where we can alter the marketing mix, and help shift it towards the marketing 1.0 model to some of these newer activities, where we will have a far better chance of extending reach and engagement.

Overcoming internal hurdles

I started holding workshops with my brand teams on social networking three years ago, and these continue today. I have continuous dialogue with all the brands that I am responsible for. We bring in people from these networks to present to the teams, so they can understand what these networks are about. We have run workshops on social media for some very senior managers as well, but your most important internal audience is the brand team.

The brand manager needs to understand how they should view digital. I believe we should be viewing much of this work on a strategic level, not as a short term measure, but as a long term strategic investment. That means part of my job is to shift some of the thinking in the brand teams – and that’s not easy.

Using networks to help develop drugs

There is a lot of interest in partnering with patient networks such as PatientsLikeMe. Novartis recently announced a partnership with PatientsLikeMe in transplantation, and UCB has partnered with them on epilepsy. Patients come together to share quantitative data about themselves, the diseases and their treatments, and this data is collated, aggregated and then shared with the rest of the community.

This has quite tremendous implications for the industry, because quite often the learning we get out of this real world data as it is called, to a certain extent, often conflicts with the data we are getting out of clinical trials. Five or six pharma companies are now working with PatientsLikeMe to see how they can use the real world data. This is driving this thing called Health 2.0, where I think value can be gained in these types of networks.

Return on investment

The question of what sort of return on investment can be achieved is an obvious one, and one I have to deal with all the time. If you consider the market research side of the engagement, it is fairly clear that the networks give you good results very quickly, and for very modest funds. So this is very cost-effective – I don’t think any marketer who I have spoken to regrets that investment. But in terms of the engagement, that is much more difficult. It is like any other social media investment, how do you measure its value? We are still working on that question.

Of course you can record who you have engaged with, how long, how many, what sort of things were discussed. Those are the sort of social media KPIs that we are now working on.

Can I deduce from that the types of hard ROI that my investment group want? No I can’t, and I wouldn’t attempt to at the moment. Everything I am currently undertaking is a pilot or an experiment – this is new territory for everybody.

If a marketer asks me: “Can you please tell me what the six month ROI of this investment is?” I have to say I can’t.

What I am saying is, try it; you have to be prepared to engage on those terms, otherwise you may as well forget it. That might sound a bit harsh, if you are fighting for that percentage of the marketing spend, it is a pretty loose argument, but we are all struggling to do something different. I think one has to have the courage and the marketing team behind you that are prepared to experiment with their spend to support you.

Len Starnes is head of Digital Marketing & Sales, General Medicine, Bayer Schering Pharma.

Related Content

Twitter launches new initiative to direct users towards credible information on vaccines

Twitter will now present users with a pinned tweet directing them towards reliable information on …

Pharma companies ‘using more in-house digital teams’

Fewer pharma companies are moving away from using external agencies for their digital marketing, a …

FDA links with PatientsLikeMe

The US Food and Drug Administration has signed a research deal with PatientsLikeMe in a …