Vir Biotech blasts out of the blocks, with $500m in bank

pharmafile | October 19, 2017 | News story | Medical Communications, Sales and Marketing | Vir Biotechnology, biotech, drugs, pharma, pharmaceutical

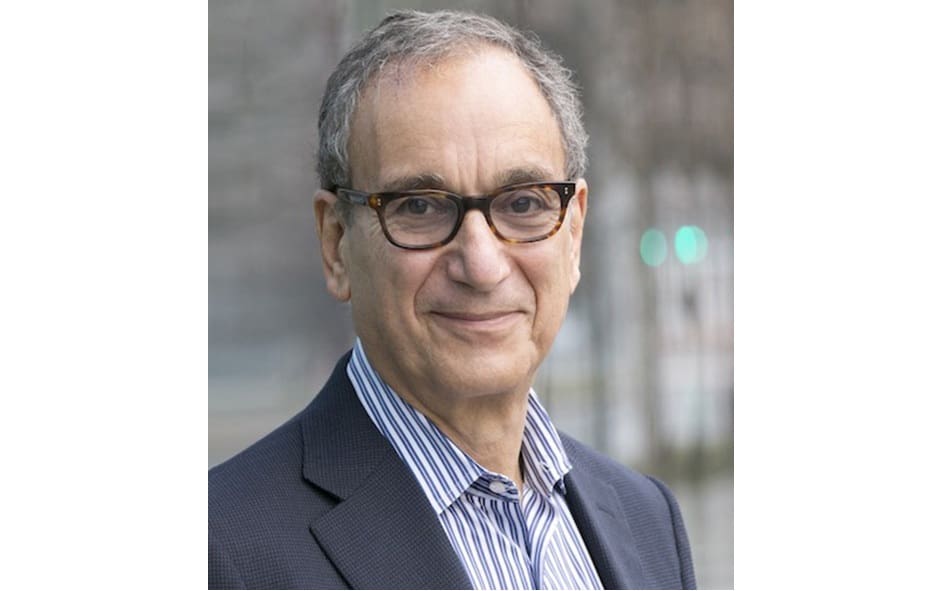

All has been quiet since former Biogen CEO, George Scangos, departed the company and then set up Vir Biotechnology in January. This has all changed with a press release announcing exactly what has been going on behind the scenes since January.

The answer is, quite a lot. The biotech has managed to drum up $500 million in financing, acquire a company and strike agreements with two companies to develop clinical and preclinical assets, as well as agreeing research deals with Stanford and Harvard. Not bad for a year’s work.

The focus of the fledgling biotech will be in the infectious disease area; it’s an area not known for being particularly lucrative but Vir believes it has an angle if it can successfully bring through a treatment for hepatitis B.

There is precedent there, Gilead boomed on the back of its hepatitis C treatment – Sovaldi was and later generations still are huge revenue generator for the company, even if the pricing and sales tactics have been controversial.

To this end, Vir has confirmed that a deal with Alnylam gets it development rights for a new generation of hepatitis B drug. Scangos has also confirmed that the biotech also signed a research collaboration deal with Visterra, which includes six antibodies to treat infectious diseases, including treatments for influenza A and RSV.

To build its pipeline, Vir announced that it had acquired Swiss company, Humabs BioMed, that bolstered its pipeline with 15 antibody development candidates, including in hepatitis B, Zika and Dengue.

“Vir is a science-driven company. We are building outstanding internal R&D, which we have coupled with nimble business development, to establish a diversified technology base as well as an exciting pipeline,” said George A. Scangos, Chief Executive Officer. “We expect to move several compounds into clinical development in the next 18 months and we have an option to acquire a portion of a Phase 2 compound targeting flu. We also continue to evaluate several near-term opportunities to acquire additional mid- and late-stage clinical compounds, as well as expand our technology base even further.”

It’s a scintillating start for the biotech and one that is certain to drum interest in the company further. It has already been backed by the Bill and Melinda Gates Foundation and SoftBank Vision Fund and, with another fundraising round expected to close by the end of the year, investment in the company could be set to mount.

Ben Hargreaves

Related Content

Arkin Capital closes $100m fund for pre-clinical and early clinical-stage biotech

Arkin Capital has announced the closing of Arkin Bio Ventures III, a $100m fund designed …

Norgine enters exclusive licensing agreement with Vir Biotechnology

Norgine has announced its exclusive licensing agreement with Vir Biotechnology, under which Norgine will commercialise …

Cellbyte raises $2.75m to fund pharma drug launch platform

Cellbyte has announced that it has raised $2.75m in seed funding for the streamlining of …