Strong growth for Roche in latest results

pharmafile | July 25, 2013 | News story | Sales and Marketing | Alexion, Q2, Rituxan, Roche

Roche has seen strong sales growth in the past six months as it lines up new products to replace its portfolio of ageing oncology medicines.

Sales for the entire group grew by 5% at constant exchange rates to CHF23.3 billion, with pharma sales up 6% to CHF18.2 billion.

The company was buoyed by demand for Roche’s three major cancer treatments: its biggest seller MabThera/Rituxan up 3% to CHF3.4 billion, Herceptin and Avastin.

Sales of Avastin were particularly good, rising 12%, due to its increased use in ovarian cancer in Europe and colorectal cancer in both Europe and the United States.

This has helped offset the loss and limitation of its breast cancer licence in a number of key markets.

The HER2 breast cancer franchise, which includes its ageing drug Herceptin, was up 11%, helped by recent launches of its next generation treatments Perjeta, growing to CHF108 million and Kadcyla to CHF83 million.

The only drug to see a fall was the off patent hepatitis C drug Pegasys, which dropped 20% to CHF724 million.

Its diagnostics unit also continued to be a strong division for the group, with sales rising 3% compared to last year, reaching CHF5.1 billion.

Roche’s chief executive Severin Schwan said: “Roche delivered strong operating results in the first half of 2013, driven by our existing portfolio, recently launched cancer medicines Perjeta and Kadcyla, as well as continued growth in the clinical laboratory business.”

Schwan added: “We will continue to focus on innovation with 68 new molecular entities in our pharma pipeline and 55 key diagnostics platforms and tests in development.”

Alexion rumours

Speaking to reporters Schwan declined to comment on reports that it has been looking to put a bid together for Alexion Pharmaceuticals, a company focused on drugs for rare diseases.

Schwan said price was just one factor the company took into account when considering a bid. “Of course the price plays a role. But the starting point is how it fits into our organisation,” Schwan said.

A move into rare disease drugs has worked well for a number of firms, and if Roche were take this option, it would mimic Sanofi’s 2011 acquisition of Genzyme. The French firm is now projected to become the world’s biggest pharma company by revenue this year, partly on the back of its Genzyme purchase.

Roche said that based on the strong operational performance in the first half of the year, it is confirming its full-year outlook.

Group sales in 2013 are also expected to increase in line with last year’s sales growth, at constant exchange rates.

Ben Adams

Related Content

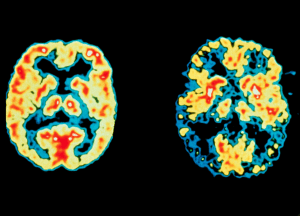

Roche receives CE Mark for blood test to help rule out Alzheimer’s

Roche has been granted CE Mark approval for its Elecsys pTau181 test, the first in …

Roche candidate shows early promise for treating haemophilia A

Roche has announced encouraging early results from its phase 1/2 trial of NXT007, an investigational …

Roche advances treatment for Parkinson’s disease

Swiss biopharma, Roche, has announced its decision to proceed with phase 3 trials of prasinezumab, …