Roche snaps up Tensha Therapeutics for up to $535m

pharmafile | January 12, 2016 | News story | Manufacturing and Production, Research and Development | Roche, Tensha Therapeutics

Roche has acquired Tensha Therapeutics, a privately-held company based in Cambridge, Massachusetts for up to $535 million.

The deal that gives Roche access to Tensha’s pioneering epigenetic technology that disrupts BET proteins in cancer treatment.

Tensha will receive $115 million upfront, plus milestone payments of up to $420 million based on clinical and regulatory successes, including with the company’s lead product, TEN-010- a small molecule BET inhibitor, currently in two Phase Ib clinical trials.

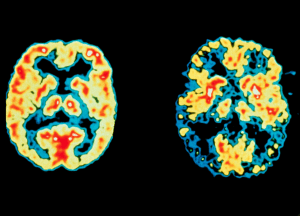

Bromodomain and extra terminal domain (BET) proteins are central mediators of gene control and cellular memory. In cancer, BET proteins activate growth and survival genes, and also contribute to cancer cell memory by binding to the genome as molecular bookmarks. Tensha says BET inhibition represents a new paradigm of targeting cellular memory, or epigenetics, in cancer, inflammation, and fibrosis.

“BET proteins are a highly promising class of therapeutic targets in cancer,” says James Bradner, founder of Tensha and associate professor at Harvard Medical School. “BET inhibitors function as targeted therapy in rare cancers with BET gene rearrangements (NUT midline carcinoma), and in common cancers as a means of inhibiting the function of the master growth control genes, such as MYC.”

“We selected TEN-010 as a highly selective, potent BET inhibitor, and we moved rapidly and strategically to advance its development,” adds Steven Landau, Tensha’s chief medical officer. “Our initial clinical data demonstrating the potential of TEN-010 in patients with NUT midline carcinoma was presented at the AACR/NCI/EORTC conference in November.”

Roche has already signed several strategic deals so far in 2016 to develop new therapeutics using the company’s Degronimid technology, for a specific group of target proteins. After preclinical development Roche has the option to participate in more pre- and clinical development and commercialisation.

Roche is paying an undisclosed upfront fee with additional development, regulatory and commercial milestone payments per targets. There are also potential sales fees and tiered royalties on sales of products. The potential value of the deal exceeds $750 million.

“Roche is a leader and early adopter of innovation in drug discovery and this significant collaboration comes at a critical time in our development,” says Marc Cohen, co-founder and executive chairman of C4. “This partnership strengthens our leadership position in the field of TPD therapeutic drug discovery. It is part of our strategy to enter into multiple target-specific partnerships that will allow us to pursue a broad set of indications in parallel, while supporting the continued development of our proprietary platform.”

Joel Levy

Related Content

Roche receives CE Mark for blood test to help rule out Alzheimer’s

Roche has been granted CE Mark approval for its Elecsys pTau181 test, the first in …

Roche candidate shows early promise for treating haemophilia A

Roche has announced encouraging early results from its phase 1/2 trial of NXT007, an investigational …

Roche advances treatment for Parkinson’s disease

Swiss biopharma, Roche, has announced its decision to proceed with phase 3 trials of prasinezumab, …