Roche lung cancer drug sees first approval

pharmafile | July 4, 2014 | News story | Sales and Marketing | ALK+, Cancer, NSCLC, Pfizer, Roche, Xalkori, alectinib, alk, zykadia

Roche has seen the first approval for its new lung cancer drug alectinib in Japan as it looks to compete against Novartis and Pfizer for market space.

The Swiss firm’s alectinib can now be used in the country as a treatment for people with non-small cell lung cancer (NSCLC) that is anaplastic lymphoma kinase fusion gene-positive (ALK+).

The drug is the third to market to treat ALK positive NSCLC after Pfizer’s Xalkori (crizotinib) was approved in the US in 2011, and Novartis’ Zykadia (ceritinib) gained the backing of US health regulators in April.

Alectinib is expected to be made available in Japan later this year, according to a statement by Roche.

“The approval of alectinib, a treatment specifically targeted to ALK+ lung cancer, in Japan is great news for people living with this difficult to treat disease,” says Sandra Horning, Roche’s chief medical officer and head of global product development.

“Another interesting aspect of alectinib is that based on early studies it may also work in people living with tumours that have spread to the brain, a difficult area to reach with current medicines. Our research will continue in this area.”

The approval was based on results from a Japanese Phase I/II clinical study for people whose tumours were advanced, recurrent or could not be removed completely through surgery (unresectable).

The drug was also granted ‘Breakthrough Therapy Designation’ by the FDA last year for patients with ALK+ NSCLC who progressed on Pfizer’s drug.

The patient population is very small with only around 1-7% of all NSCLC cancer patients thought to have the ALK mutation. These patients are often non-smokers and younger people.

Sales potential

But this has not stopped these medicines from bringing in high revenue: Xalkori, which was the talk of ASCO in 2011, brought in sales of around $350 million last year but is expected to gain new licences and extensions in the future.

Analysts at Cowen and Co. have predicted the medicine could generate annual peak sales of around $1 billion by 2020, putting it firmly into the blockbuster bracket.

Novartis’ drug is intended as a second-line treatment and can only be used for patients who have failed on Pfizer’s lung cancer treatment Xalkori (crizotinib) – the same licence Roche’s new medicine is seeking in the US.

Pfizer’s drug has proven effective as a first-line treatment, but some patients become resistant to the drug – a common problem for many oncology products.

Both drugs from Novartis and Roche are aimed at helping those patients who are no longer benefiting from Xalkori. The two firms will most likely seek a first-line approval in the future however, given the greater revenue potential that licence entails.

Analysts predict Novartis’ new medicine could make around $350 million in peak annual sales, but will struggle to gain as much traction as Xalkori, given its current treatment setting. The same may well be true for alectinib.

But these drugs have proved expensive. In the UK, a month’s worth of Xalkori costs £4,689 ($8,046), and the drugs pricing watchdog NICE estimates the average cost of a course of treatment would be between £37,512 and £46,890 – rising to more than £51,000 if patients are treated after progression.

NICE has decided not to fund the drug in England due to its high cost.

Ben Adams

Related Content

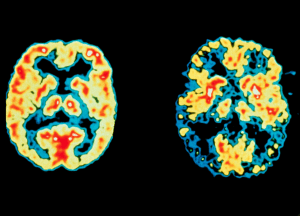

Central nervous system cancer metastases – the evolution of diagnostics and treatment

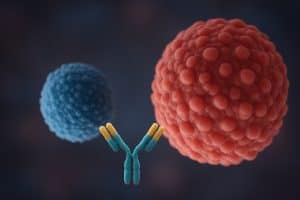

The current forms of immunotherapy, how T cell therapy works and what the future holds

Roche receives CE Mark for blood test to help rule out Alzheimer’s

Roche has been granted CE Mark approval for its Elecsys pTau181 test, the first in …

BioMed X and Servier launch Europe’s first XSeed Labs to advance AI-powered antibody design

BioMed X and Servier have announced the launch of Europe’s first XSeed Labs research project, …