Merck sees sales dip

pharmafile | July 31, 2013 | News story | Sales and Marketing | Merck, Q2, Singulair, sales

A catastrophic decline in sales of asthma medicine Singulair is among the key reasons why Merck’s pharma revenue fell 12% in the second quarter of the year.

Singulair patents expired in the US in August 2012 and in Europe last February and worldwide sales were in freefall, down 80% year-on-year to $281 million in the three months to the end of June.

Meanwhile Vytorin, Merck’s drug for lowering LDL cholesterol, fell 6% to $417 million.

Merck’s pharma sales dip to $9.3 billion ($11 billion for the group overall) was not helped by the negative impact of currency exchange.

But it was not all bad news: worldwide sales of the Januvia/Janumet diabetes franchise were up 5% to $1.5 billion in the second quarter, a figure which included a 5% negative impact from foreign exchange.

Sales of HIV integrase inhibitor Isentress rose 4% to $412 million, driven by growth in the US and Europe. And human papillomavirus (HPV) vaccine Gardasil was up 18% to $383 million, driven by higher sales in the US as well as tenders in Latin America in 2013.

In common with virtually every other multinational pharma group, the importance of emerging markets was clearly visible: sales here were up 7%, accounting for a fifth of all Merck’s pharma sales in Q2, with China seen as a particular driver.

“With seven of our top ten products growing in the second quarter and solid performance overall, we continue to navigate significant patent expiries and adapt to the evolving global healthcare environment,” said Kenneth Frazier, Merck’s chief executive.

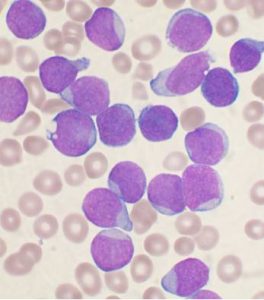

“We remain committed to pursuing innovative, best-in-class science that translates into medically important products, such as our PD-1 inhibitor for oncology,” he continued. “To enable further investment in promising growth opportunities, we continue to manage costs effectively, as reflected in our results for the quarter.”

An ongoing Phase Ib expansion study is evaluating the safety and efficacy of MK-3475, an investigational antibody therapy targeting PD-1 in patients with advanced melanoma.

At current exchange rates, Merck now says full-year 2013 sales will be 5-6% below last year’s levels, with foreign exchange accounting for approximately three percentage points of the decline.

Keeping shareholders sweet is also a key theme for pharma, and Merck is continuing to return cash to its own investors, with a $5 billion accelerated share repurchase announced in May.

Adam Hill

Related Content

Merck to acquire Curon Biopharmaceutical’s B-Cell Depletion Therapy

Merck have announced that they have entered into an agreement with private biotechnology company Curon …

Merck and Daiichi Sankyo expand development and commericalisation agreement to include MK-6070

Daiichi Sankyo and Merck (known as MSD outside of the US and Canada) have announced …

CHMP gives positive opinion for Merck’s KEYTRUDA for unresectable or metastatic urothelial carcinoma

Merck (known as MSD outside of the US and Canada) has announced that its anti-PD-1 …