Lung cancer market to hit $10.9bn by 2021

pharmafile | September 10, 2015 | News story | Sales and Marketing | AZD9291, GBI Research, GlobalData, NSCLC, industry analysis, industry intelligence, industry reports, keytruda, market intelligence lung cancer, market reports, market trends, non small cell lung cancer, non-small cell lung cancer, opdivo, world conference on lung cancer

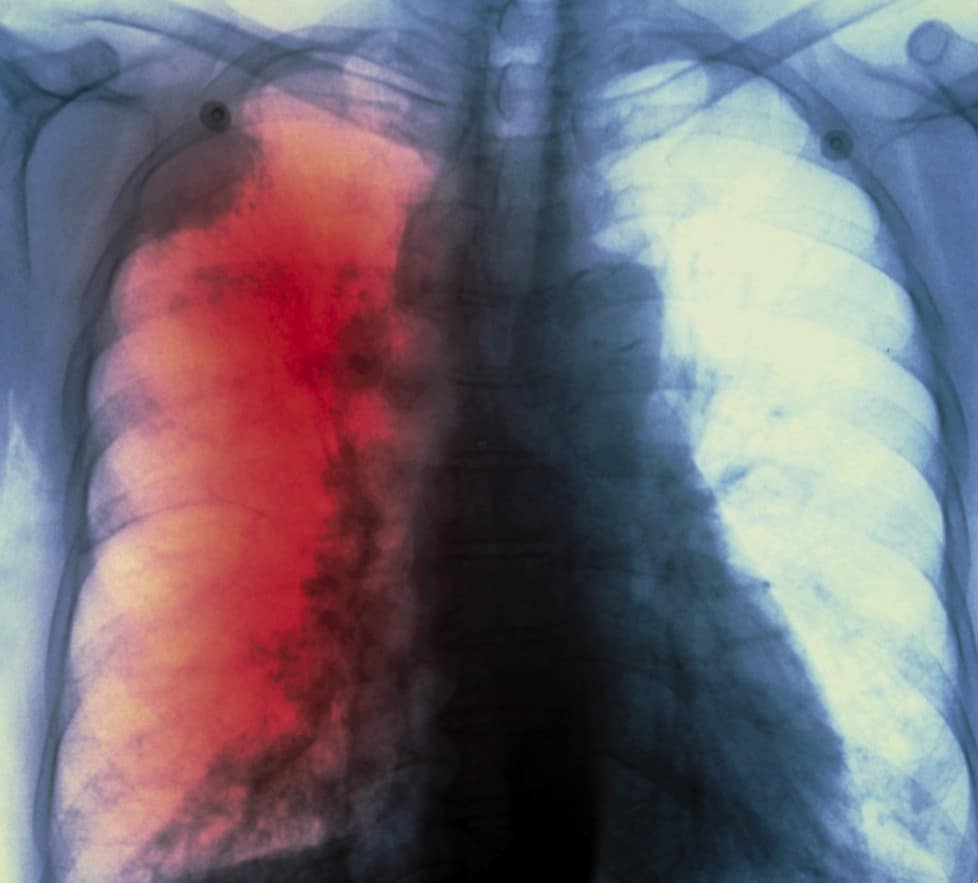

The global market value for non-small cell lung cancer treatment will rise from $6.9 billion in 2014 to $10.9 billion by 2021, new industry figures show.

An analysis by market intelligence firm GBI Research has found the non-small cell lung cancer (NSCLC) market will achieve a compound annual growth rate of 8.5%. The growth will mostly driven by growth across in the US, Canada, UK, Germany, France, Italy, Spain and Japan.

The market growth will also be driven primarily by the introduction of novel immune-checkpoint inhibitors, such as Opdivo (nivolumab) and Keytruda (pembrolizumab), to new markets during the forecast period. These and other new immunotherapies in company pipelines will “capture a significant share of the second-line treatment space”, the report predicts, eventually ‘commanding premium pricing’, analysts forecast.

Joshua Libberton, who is senior analyst for GBI Research, says: “The majority of new drugs will target the second-line treatment of NSCLC in both squamous and non-squamous patient subsets, leading to a crowded treatment algorithm for these patient populations.

“Ultimately, due to their strong clinical performances, immunotherapies will have a greater uptake than other second-line market entrants, such as [Teva and Oncogenex Pharma’s] custirsen and [Clovis Oncology’s] rociletinib.”

The NSCLC therapeutics market will also see the launches of two first-line treatments for squamous cell patients during the forecast period, namely [Lilly’s] necitumumab, which is due to launch in early 2016, and Bristol-Myers Squibb’s Yervoy (ipilimumab) in 2017.

Libberton continues: “The squamous patient subset is currently very limited in terms of first-line treatment options, meaning these new drugs will be important for driving market growth and improving patient outlook.

“While generic chemotherapies will remain an integral aspect of NSCLC treatment, with platinum-based regimens being crucial in the first-line setting for all patients and docetaxel being a key therapy for second-line patients, their market share will slowly decline by 2021 as new premium, targeted therapies enter the arena.”

The prediction came as several big pharma companies presented data at the World Conference on Lung Cancer, in Denver, Colorada. AstraZeneca presented updated data on AZD9291 – which has recently been granted Promising Innovative Medicine status in the UK – in first-line patients with epidermal growth factor receptor mutation (EGFRm) positive advanced NSCLC and previously-treated patients with EGFRm T790M mutation-positive NSCLC.

The data demonstrated that in 60 patients who received AZD9291 once daily in the first-line setting, 72% were progression free after one year, and the overall response rate was 75%.

Lilian Anekwe

For more pharma industry intelligence from GlobalData, visit our market reports page.

Related Content

HUTCHMED completes enrolment in phase 3 trial for lung cancer

HUTCHMED has completed patient enrolment for the SANOVO phase 3 clinical trial, investigating the use …

FDA grants accelerated approval for advanced non-small cell lung cancer treatment

The US Food and Drug Administration (FDA) has granted accelerated approval to Dizal Therapeutic’s Zegfrovy …

Bristol Myers Squibb receives positive CHMP opinion for Opdivo treatment

Bristol Myers Squibb (BMS) has received a positive opinion from the Committee for Medicinal Products …