Elan to spin off drug discovery arm

pharmafile | August 14, 2012 | News story | Research and Development, Sales and Marketing | Elan, Neotype Biosciences, Tysabri, multiple sclerosis

Elan Corporation is to spin off its drug discovery arm Neotype Biosciences to create a separate, quoted company by the end of this year.

The Dublin-based biotech firm, which specialises in neuroscience, says the move will generate immediate profits – it is targeting $1 earnings per share by 2015.

The company also hopes it will make Elan more attractive to outside investment: the spin-off “will enable investors to align timelines, risk and returns in order to best achieve their investment objectives”, it said in a statement.

“The strengthening of the balance sheet, capital structure, income statement and progression of the science for the benefit of patients, has been a constant goal and objective,” said Elan chairman Robert Ingram and chief executive Kelly Martin.

Neotype, set up in 2010, will continue to focus on innovation, intellectual property creation and translational science – turning investigational drugs into marketable ones – particularly in chronic degenerative diseases such as Parkinson’s.

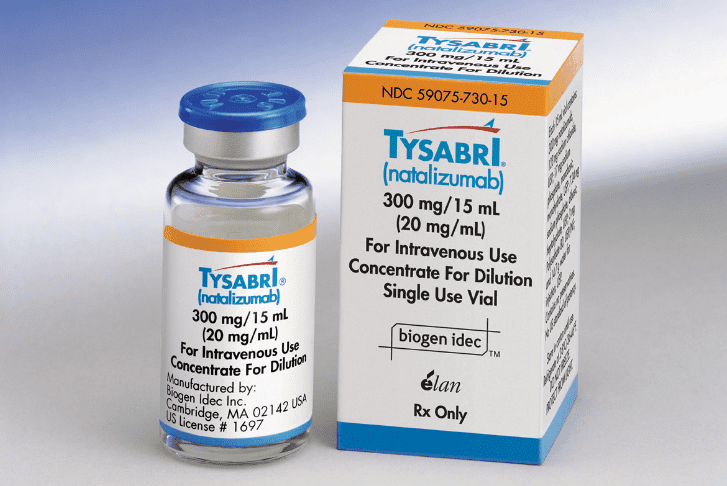

Meanwhile Elan will pin hopes on three main assets: the first of these is multiple sclerosis treatment Tysabri, marketed with Biogen Idec, which the companies hope could have other indications, while the second is Phase 2/Phase 2b small molecule ELND005.

“The dominant focus will be broadening and deepening patient access to Tysabri on a global basis and registering ELND005 for multiple indications in neuropsychiatry and other symptomatic indications,” Martin said.

The third major area is Elan’s financial interest in Janssen AI which (with Pfizer) manages the AIP portfolio including bapineuzumab.

There was disappointing news there earlier this month, when Johnson & Johnson abandoned Phase III development of bapineuzumab IV in mild to moderate Alzheimer’s.

This failure will mean a “significant reduction in spending through the end of next year”, the company said – but it insisted the decision to split Elan and Neotape was not influenced by the failure.

“These discussions took place well in advance of the recent release of the top line outcomes of the bapinezumab Phase III trials,” Elan said.

Further information on how shareholders might benefit, including details of “debt repurchases, share buy backs, dividends or all three” will be forthcoming over the next few months, concluded Ingram and Martin.

While the spin-off is a bold move, Elan is no stranger to major corporate restructure: less than a year ago it completed a near-$1 billion merger with drug delivery specialist Alkermes.

The completion of the handover of Elan Drug Technologies provided Elan with $500 million in cash and a 25% equity stake in the new technology company, Alkermes plc.

Adam Hill

Related Content

Sanofi shares results from phase 2 trial for frexalimab in MS treatment

Sanofi has announced new phase 2 trial data for its CD40L monoclonal antibody, frexalimab, for …

Sanofi announce positive phase 2 data for MS drug frexalimab

French pharmaceutical and healthcare company Sanofi have announced positive trial data from its phase 2 …

Biogen announces collaboration on novel MS treatment

Biogen and InnoCare Pharma have announced a license and collaboration agreement for orelabrutinib, an oral …