Bayer’s challenger to Lucentis shows promise

pharmafile | November 22, 2010 | News story | Research and Development, Sales and Marketing | Bayer, Lucentis, Novartis, Regeneron, Roche, VEGF Trap-Eye, age-related macular degeneration, avastin, wet AMD

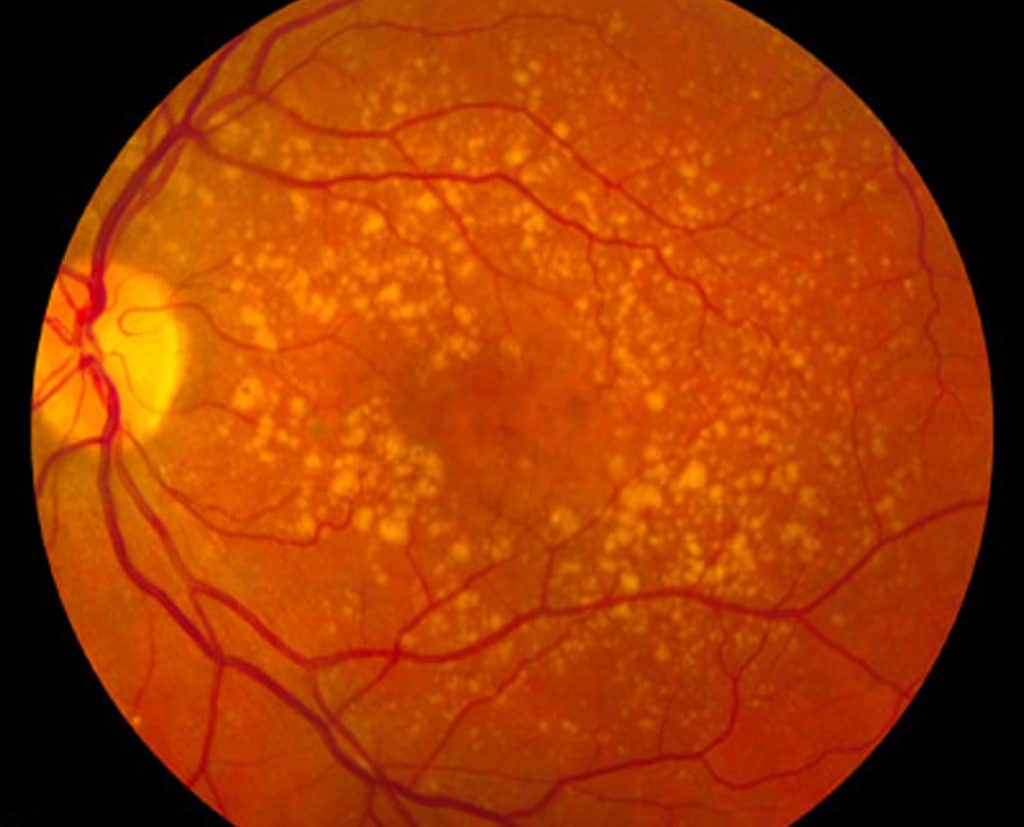

Phase III data for a new age-related macular degeneration (wet AMD) treatment show it is as good as Lucentis, the blockbuster drug co-marketed by Novartis and Roche.

VEGF Trap-Eye (aflibercept) is being developed by Bayer and Regeneron, who are testing the drug in a non-inferiority trial comparing it with the monoclonal antibody drug Lucentis (ranibizumab).

Results from the VIEW 1 and VIEW 2 trials showed various doses of the new drug were as good as the standard 0.5mg monthly injection of Lucentis. Significantly, this included a 2mg dose of VEGF Trap-Eye every two months – a dosing that is more convenient for patients, which the companies hope will give it an edge over Lucentis.

Lucentis has to be injected once a month into the eye to treat the degenerative eye disease, which is the leading cause of blindness for over 65s in the US and Europe.

The drug earned Novartis $1.2 billion in 2009 in markets outside the US, while it earned another $1.2 billion for Roche in the US alone.

Bayer and Regeneron hope to win a share of this lucrative market with their rival drug. Analysts Jeffries say VEGF Trap-Eye could hit peak sales of $2 billion, with Bayer and Regeneron splitting the revenues along the same ex-US/US lines as their rivals.

“The currently available anti-VEGF therapies have significantly advanced the treatment of wet AMD, actually improving vision in many patients. However, monthly injections are required to optimise and maintain vision gain over the long-term,” said Ursula Schmidt-Erfurth, Professor and Chair of the Department of Ophthalmology at the University Eye Hospital in Vienna, Austria and the VIEW 2 Principal Investigator.

“The results of the VIEW studies indicate that VEGF Trap-Eye could establish a new treatment paradigm for the management of patients with wet AMD – predictable every-other-month dosing without the need for intervening monitoring or dosing visits.”

Dr Schmidt-Erfurth said ophthalmologists had begun giving patients Lucentis every other month in clinical practice, but anecdotal evidence suggests this increases the chance of vision problems.

In the second year of the studies, patients in VIEW 1 and VIEW 2 will be treated with the same dose per injection, but will be given it only every three months. If there is any worsening of AMD, however, they will be given it more frequently based on protocol-defined criteria (called “quarterly capped PRN” dosing).

VEGF Trap-Eye is also in phase III development for the treatment of Central Retinal Vein Occlusion (CRVO), another major cause of blindness, in two identical studies, with initial data anticipated in early 2011.

Meanwhile, it is in phase II development for the treatment of Diabetic Macular Edema (DME), with promising six month data released earlier this year.

VEGF Trap-Eye is expected to be filed for wet AMD in early 2011.

Avastin versus Lucentis

Another development of major importance in the market is a further head-to-head trial, this time between Avastin and Lucentis.

The two drugs were both discovered by Genentech (now part of Roche) and are very similar in their molecular composition. Avastin is not licensed to treat wet AMD but ophthalmologists frequently use it off license to treat the condition because it is far cheaper than Lucentis.

In the US, Lucentis costs around $2,000 a dose, whereas Avastin costs approximately $50.

The US National Eye Institute set up the head-to-head trial in 2008, and the results are expected in early 2011. If, as anticipated, the results show Avastin is as safe and effective as Lucentis, the trial will further undermine Lucentis’ sales.

Similar trials are being conducted in the UK and Europe. Positive results could help the UK’s cost effectiveness body NICE recommend Avastin – even though it is not licensed for the indication.

Industry commentators say the Avastin versus Lucentis trials could set a dangerous precedent for the industry, with independent head-to-head trials and not industry-sponsored studies determining how drugs are used.

Andrew McConaghie

Related Content

Evotec and Bayer announce new kidney disease study

Evotec and Bayer have announced the initiation of a phase 2 clinical study in kidney …

Novartis receives SMC approval for early breast cancer treatment

Novartis has announced that its treatment for early breast cancer, Kisqali (ribociclib), has received approval …

Sanofi and Regeneron’s Dupixent receives CHMP recommendation for chronic spontaneous urticaria

Sanofi and Regeneron have received a positive opinion from the European Medicines Agency’s (EMA) Committee …