Avastin helps Roche outpace the market again

pharmafile | April 16, 2009 | News story | Sales and Marketing | Roche

Strong sales growth across all its business divisions, including prescription medicines has helped Roche outpace the market again in the first quarter of 2009.

The company achieved 8% growth overall in the period, double the current market growth rate.

Roche has also secured the acquisition of Genentech in the last few weeks, and intends to reorganise and save money by merging some operations with its Californian biotech subsidiary.

One of the key reasons for buying out Genentech was to gain full future rights to Avastin.

Once again the drug led the growth among the company's prescription drugs, the cancer treatment increasing sales by 30% by achieving revenues of 1.5 billion Swiss francs.

The drug is licensed to treat advanced colorectal, breast, lung and kidney cancer, and is set for further licensed indications this year.

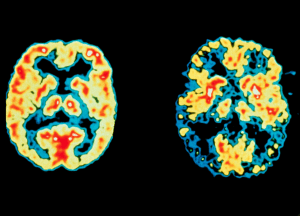

In March an FDA advisory panel recommended it use for previously treated (relapsed) glioblastoma, the most aggressive form of brain tumour. A decision on accelerated approval is expected in May.

Roche chief executive Severin Schwan said: "With growth of 8%, the Roche groups sales developed very well in the first three months of 2009. Sales in both divisions continued to grow significantly faster than their respective markets. We are therefore confident that we can achieve our full-year targets."

Turning to the Genentech merger, Schwan said the company had already made 'considerable progress' with integrating the two companies.

From 1 May, Genentech's chairman and chief executive Arthur Levinson will give up day-to-day control of the company and become chair of its new board and oversee the integration on a strategic level.

Pascal Soriot, currently head of Roche's global pharma commercial operations, will take over as Genentechs chief executive. Levinson and Soriot will work as co-leaders of the integration team to design the future set-up of the combined company.

Levinson will also be nominated to sit as a member of Roches board at the next shareholders AGM in 2010.

One of the most sensitive issues has been whether or not the merger could kill off Genentech's unique culture which made it a success in the first place.

Roche has made a number of concessions to Genentech's existing set-up, and so far the feared mass resignation of leading scientists has not materialised.

Severin Schwan commented: "We are delighted that Art Levinson will continue to support us in an active role and that many outstanding individuals from both Genentech and Roche have committed themselves to driving forward the combined businesses."

Roche paid $46.8 billion to gain overall control of Genentech, and financed the acquisition by raising $39 billion in the bond market, finding the rest from its cash reserves.

The company has set itself the goal of having the merger largely completed by the end of 2009. Roche plans to update its full-year outlook to include the impact of the Genentech transaction when its half-year results are announced on 23 July.

Pipeline prospects

A new antibody-drug conjugate combination of Herceptin with a cytotoxic drug DM1 entered phase III trials in February. The new combination means Herceptin targets the cancer cells as usual, but then releases the cytotoxic agent into the cell, helping to kill off the cancer cell but not affect surrounding healthy tissue.

The first phase III trial (EMILIA) investigating the novel antibody drug conjugate trastuzumab-DM1 in the second-line treatment of patients with HER2-positive metastatic breast cancer commenced in February.

Meanwhile phase III development of dalcetrapib (CETP inhibitor), for dyslipidemia, is progressing. Dalcetrapib is from the same class as Pfizers ill-fated torceptrapib, which the company had hoped would be a blockbuster but was forced to abandon in 2006 after safety concerns emerged.

Roche also have taspoglutide (GLP-1 analogue) for type II diabetes in phase III, and say initial data is expected by the end of the year.

Roche says it is looking to develop diabetes drugs which reduce cardiovascular risk as well as glucose levels. Accordingly, Roche has moved R7201, a novel SGLT-2 inhibitor licensed from Chugai, into phase II testing. It says early stage compounds that only lower glucose levels, including all glucokinase activators, have been discontinued.

Related Content

Roche receives CE Mark for blood test to help rule out Alzheimer’s

Roche has been granted CE Mark approval for its Elecsys pTau181 test, the first in …

Roche candidate shows early promise for treating haemophilia A

Roche has announced encouraging early results from its phase 1/2 trial of NXT007, an investigational …

Roche advances treatment for Parkinson’s disease

Swiss biopharma, Roche, has announced its decision to proceed with phase 3 trials of prasinezumab, …