Weekly Movers: Valeant, Anacor, Regeneron…

pharmafile | May 23, 2016 | Feature | Manufacturing and Production, Research and Development, Sales and Marketing | Acorda, Aduro Biotech, Anacor Pharma, Financial, MacroGenics, Merck, Regeneron Pharma, Valeant Pharma

The earnings season came to a close with Germany’s Merck doubling its first-quarter profits. For the week, drug trials, analyst comments and deals were some of the drivers behind big share movements.

Here’s a quick look at some of the biggest movers of the week:

Shares in Valeant Pharmaceuticals (NYSE: VRX) rose almost 4% after it was revealed David Tepper’s hedge-fund firm Appaloosa bought nearly 1 million shares in the company in the first three months of 2016.

The shares were subsequently sold during the first quarter, according to regulatory filings.

Shares in Anacor Pharmaceuticals (Nasdaq: ANAC) soared over 55% after Pfizer (NYSE: PFE) announced it was buying the company in a deal valued at $5.2 billion.

The acquisition of Anacor will see Pfizer obtain its inflammation and immunology portfolio. Anacor’s flagship product, crisaborole, is currently under review by the US Food and Drug Administration (FDA) for the treatment of eczema, or mild-to-moderate atopic dermatitis. Crisaborole is a differentiated non-steroidal topical PDE4 inhibitor with anti-inflammatory properties.

Regeneron Pharma (Nasdaq: REGN) rose almost 4% after receiving positive comments for the stock. In a report the company shares were indicated to be “attractively priced,” considering its growth potential.

Shares in Aduro Biotech (Nasdaq: ADRO) dropped to closed down over 16% after the company said mid-stage trials of its drug to treat pancreatic cancer failed to improve overall survival.

Pre-market trading in the shares was halted following the news. Aduro’s shares fell 33% in premarket trading.

Chief Executive Stephen Isaacs said: “This is an unexpected outcome,” adding “we are surprised by the divergence of these data from the results of our Phase IIa study.”

It is estimated that more than 337,000 people worldwide are diagnosed with pancreatic cancer each year and more than 330,000 people die from the disease.

MacroGenics (Nasdaq: MGNX) shares soared nearly 17% after the company announced a global collaboration and license agreement for MGD015 with Janssen Biotech.

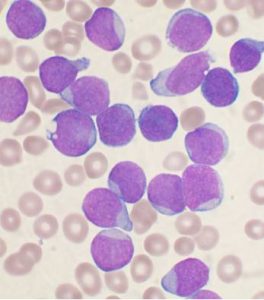

The product candidate, MGD015 is being developed as a treatment for various haematological malignancies and solid tumours, the company said in a statement. MacroGenics has already demonstrated that the experimental therapy can kill targeted cells both in vitro and in vivo, with high response rates in several mouse tumour xenograft models.

Under the terms of the deal, MacroGenics will receive a $75 million upfront license fee, and an additional $665 million in milestone payments.

Acorda Therapeutics (Nasdaq: ACOR) stock dropped over 3% after the company said it is ending trials for Plumiaztm (diazepam) nasal spray to treat epilepsy seizures. The company said data from the ongoing clinical trials did not demonstrate its bioequivalence to Diastat rectal gel, needed to re-file the New Drug Application (NDA).

Ron Cohen, Acorda’s chief executive, said: “We are very disappointed by this outcome, and for those in the epilepsy community who experience seizure clusters.”

Anjali Shukla

Related Content

Merck to acquire Curon Biopharmaceutical’s B-Cell Depletion Therapy

Merck have announced that they have entered into an agreement with private biotechnology company Curon …

Merck and Daiichi Sankyo expand development and commericalisation agreement to include MK-6070

Daiichi Sankyo and Merck (known as MSD outside of the US and Canada) have announced …

CHMP gives positive opinion for Merck’s KEYTRUDA for unresectable or metastatic urothelial carcinoma

Merck (known as MSD outside of the US and Canada) has announced that its anti-PD-1 …