The changing of the guard – Q3 round up

pharmafile | November 25, 2011 | Feature | Business Services, Manufacturing and Production, Medical Communications, Research and Development, Sales and Marketing | Lipitor, Q3, Ranbaxy

Pfizer

Of all the patent cliffs in pharma, Lipitor’s expiry represents the biggest. Pfizer is now staring over the precipice, with the first generic copy due to go on sale shortly after Thanksgiving, on 30 November. Lipitor’s demise in the US will decimate its revenues, and European markets will follow suit early next year. Analysts at EvaluatePharma forecast that the loss of the $12 billion a year from Lipitor will knock Pfizer of its perch as the biggest firm by revenue.

Sanofi is predicted to take the top spot next year, with Pfizer relegated to third place (see opposite page). Lipitor’s patent expiry will not just be the end of an era for Pfizer, but for the whole industry – no product looks set to equal or surpass its peak sales of $13.7 billion which it achieved in 2006.

Pfizer’s futureDespite its expected descent from the No.1 spot, Pfizer is by no means struggling. Chief executive Ian Read says the firm is ‘well prepared’ for the loss of Lipitor and believes Pfizer’s pipeline can soften the blow. Its Q3 sales saw strong sales of Lyrica and its Prevnar vaccines coupled with favourable exchange rates help it deliver a strong performance. Total sales for the third quarter were up 7% compared to a year ago as income reached $17.2 billion.

The majority of this increase came from favourable exchange rates, but 1% of its growth stemmed from core products. This includes childhood vaccine Prevnar/Prevenar 13 that was up 35%, spurred on from impressive growth in emerging markets. Its pain drug Lyrica also saw strong gains on last year as operational sales increased 19% to $961 million for the quarter. Patent expiries took a bite out of revenues however, with the biggest loss coming from a 40% drop in sales of eye drug Xalatan after generic rivals became available in March.

Ian Read said: “Overall, I am very pleased with our financial performance, despite the impact of product losses of exclusivity totaling approximately $950 million this quarter and the challenges posed by current global market and economic conditions.”

Anticoagulant Eliquis for stroke prevention in patients with atrial fibrillation is ready for launch, while tofacitinib (rheumatoid arthritis) and axitinib (advanced renal cell carcinoma) and recently launched lung cancer drug Xalkori (crizotinib) are all expected to be major products.

Bayer

Bayer has posted modest results for the third quarter, with growth in emerging markets compensating for austerity measures in Europe and the US. Group sales were up 1% in the third quarter to €8.7 billion, which includes its CropScience, consumer healthcare and MaterialScience businesses.

Sales in the conglomerate’s pharmaceuticals division rose just 0.3% when currency and certain products are adjusted. Pharma sales were down in Europe and North America due to the negative effects of austerity measures and health reforms respectively. Bayer remained in growth mainly thanks to developments in Asia-Pacific and Latin America, with sales in these countries advancing 10.5% to €9.74 billion in the first nine months, with China and Brazil contributing the lion’s share of growth.

Bayer’s chairman Marijn Dekkers said that the trend in its pharma division in the emerging markets was ‘particularly encouraging’ – and necessary as mature markets fail to help show growth. Among the segment’s top pharma products, the Yaz franchise of oral contraceptives was one of the strongest performers, with sales up 16.5 per cent. Cancer treatment Nexavar also had a good quarter and was up by 4.5%, with adjustments, mainly driven by its liver cancer indication.

By contrast, sales of the blood-clotting drug Kogenate declined 3.9%, due to problems with distribution. Dekker highlighted the recent recommendation by an FDA advisory committee for the use of Xarelto in atrial fibrillation. The drug (co-marketed with J&J) is still tipped for blockbuster status, but analysts have downgraded forecasts after rival oral anticoagulants: Boehringer’s Pradaxa and Pfizer and BMS’ Eliquis, have shown superior performance in atrial fibrillation.

GSK

GlaxoSmithKline has posted a set of healthy figures for the third quarter, underlying its return to growth after a tough year. Group turnover was up 3% for the third quarter to £7.1 billion, with underlying pharma and vaccines up 3 per cent. Underlying growth was up 6% when troubled diabetes drug Avandia, herpes treatment Valtrex (which has succumbed to generic erosion) and pandemic products are taken out of the equation, representing a stable return to growth for the UK firm.

Andrew Witty, chief executive of GSK said: “As evidenced this quarter, the drag from Avandia, Valtrex and pandemic products has significantly reduced and although there is likely to be some quarterly variability, we continue to expect underlying sales growth to translate into reported sales growth in 2012.”

Vaccines were particularly strong in the third quarter, up 14%, principally due to sales of Cervarix for the rollout of Japan’s national HPV programme, translating into a 57% growth in the region. GSK saw steady results in the US, with underlying growth – at constant exchange rates – reaching 1%, with President Obama’s health reforms hitting sales. Europe was the worst affected region with underlying sales down 4% to £1.41 million as austerity measures continue to bite. This was offset by another strong showing in emerging markets, up 11% to £949 million for the quarter.

Sales of its respiratory drugs continued to decline, top-selling Seretide down 3% to £1.22 billion, mainly from low sales in the US. Most of its other products saw steady increase however – with Avodart, licensed to treat benign prostatic hyperplasia, up 19% to £188 million. Bipolar drug Lamictal also saw a healthy growth of 18%, up to £153 million.

During the quarter GSK launched one of its biggest future hopes – the lupus treatment Benlysta, with partner Human Genome Sciences. The firm reports that total sales reached $18.8 million for its first full quarter, of which it received £6 million – this has disappointed analysts, who forecast at least $20 million. There is speculation GSK will acquire HGS, which would make the venture more profitable. Witty added that the firm would continue its share buy-back scheme, which will be partly financed by the upcoming sales of its OTC business.

“The performance of the business and resulting cash generation is allowing us to continue to increase returns to shareholders,” he said, announcing a further 6% increase in the dividend to 17p. GSK expects to increase its share repurchases this year from around £2 billion to up to £2.3 billion.

AstraZeneca

AstraZeneca saw its revenue decline in the third quarter due to an onslaught of patent expiries, but still saw its profits rise. The firm lost $350 million from patent expiries in the quarter, dragging down sales by 2%, but cost-cutting and income from the sale of medical devices unit Astra Tech helped increase profits. Sales in Western Europe were down by a massive 50% due to the combination of major patent losses and healthcare spending cuts across the continent.

Among the generic casualties were heartburn treatment Nexium, which saw sales fall 14% in Europe as generic versions of the medicine flooded the market. Crestor led growth among the company’s top products, rising 14% at constant exchange rates, up to $1.66 billion, thanks to strong US sales. The Seroquel franchise saw a 4% increase in sales to reach $1.4 billion, while respiratory drug Symbicort rose 9% to $755 million compared to last year.

David Brennan, chief executive of AstraZeneca said the company’s ‘disciplined execution’ continued to generate strong cash returns, with dividends and net share repurchases well ahead of last year. Less encouraging news from AstraZeneca and Bristol-Myers Squibb’s co-developed diabetes treatment dapagliflozin, which has been further delayed by the FDA, and the companies must now submit more data.

Teva

Sales growth at Teva was modest in Q3, rising 2% to $4.34 billion, with growth predominately coming from branded drugs. The Israel-based company is the world’s leading generics company, but it is now diversifying into the patented medicines field. A third of sales now come from patented products, and Teva has added to its patented portfolio with the recent acquisition of speciality firm Cephalon, bringing with it oncology, pain and CNS drugs.

The Q3 period also saw a 26% growth for its biggest selling branded drug Copaxone, for treatment of multiple sclerosis, which made the firm just over $1 billion for the quarter. Patented respiratory product sales totaled $238 million in the quarter, an increase of 15%, primarily driven up by impressive growth in the US. Women’s health products and Parkinson’s disease drug Azilect also achieved growth of 6% and 20% respectively.

Exchange rate changes also played a part and added $148 million to sales, largely due to the strength of the euro against the dollar. But overall growth was slowed by a 48% drop in US sales as the firm failed to launch any new drugs in the country. Sales in Europe were healthier and grew to $1.3 billion, up 24% in local currencies, coming from its recent acquisition of the generic drugmaker Ratiopharm.

Shlomo Yanai, Teva’s president and chief executive said: “The third quarter produced an overall mixed performance: we had strong European and international generic sales, combined with strong results from our branded units.” He added that the period lacked any significant new launches, but predicts a strong Q4 based on the exclusive launch of a generic form of Lilly’s antipsychotic Zyprexa in the US, which lost its patent in the country last month.

Roche

Roche saw its Q3 results dragged down by the strength of the Swiss franc, its revenues falling 14.5% to 9.82 billion Swiss francs ($11 billion). Underperformance in a number of key products also hit results, including oncology blockbusters Avastin and Herceptin. The Swiss franc has hit all time highs against the dollar and the euro this year, and Roche expects it will take 12% off its full year revenues. The problem is such that the Swiss National Bank moved to halt the rise of the franc’s value last month, amid fears it was damaging the country’s vital export business.

The Basel-based firm has not altered its forecast of core earnings per share growth of around 10% in local currencies, as well as its target of low single-digit sales growth in local currencies, excluding Tamiflu. Without the influence of exchange rates and excluding Tamiflu results, sales rose 2% in the period. Roche says it is on course to find 1.8 billion francs in cost savings this year and to make annual savings of 2.4 billion francs by the end of 2012.

Chief among its portfolio worries is the decline in Avastin. Sales have declined after the FDA rescinded its US licence to treat breast cancer in June, with the EMA heavily restricting its use. Avastin sales fell 10% at constant exchange rates, but Roche say this decline will tail off within six months. Roche is still awaiting the final FDA decision, but the hope of a last minute reprieve is remote.

More promising is the news that Avastin has just gained EU approval for use in women with advanced ovarian cancer. Sales growth of Herceptin slowed to 4% (from 12% in the preceding three months) including a 23% decline in sales in Japan, reversing a 30% rise seen earlier in the year. But analysts are cheered by encouraging news from the company’s pipeline.

Roche has set itself the target of launching nine new blockbusters by 2016, and recently gained US marketing approval for skin cancer drug Zelboraf and its companion diagnostic. Other promising late stage drugs include breast cancer treatment pertuzumab – tipped for blockbuster status, which Roche expects to submit for approval by the end of 2011.

Related Content

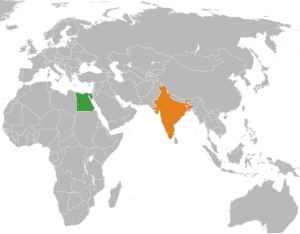

Sun Pharma inaugurates first Egypt production facility

Ranbaxy, a subsidiary of India’s Sun Pharma, has opened its first production facility in Egypt …

Daiichi pulls out of India with closure of 170-strong R&D plant

Japanese pharma firm Daiichi Sankyo has announced its intention to close its R&D centre in …

Valeant’s tough year gets worse with Q3 loss of $1.22 billion

It’s easy to say that Valeant hasn’t had a great year so far. Unfortunately for …