AZ bullish on its future – but analysts wary

pharmafile | January 15, 2014 | News story | Sales and Marketing | AstraZeneca, Roche, analysts, jp morgan

AstraZeneca is combating fears over its long-term future by assuring investors that it has the pipeline and the tenacity to turn itself around.

The firm told the JP Morgan healthcare conference this week that it will put a halt to the slide in its global sales by 2017, as it makes progress in restocking its sparse pipeline of new medicines.

By setting a target date for a return to growth, the company indicated that it would reap $3 billion more than the City expects from acquisitions and from developing new drugs – including treatments for diabetes, gout and cancer.

Analysts had forecast revenue for 2017 of $22 billion, compared with an estimated $22 billion to $25 billion for last year. The company’s shares rose by 2.5% yesterday to £37.28 in response to the news.

The firm has been hit by a slew of late-stage failures for a number of key drugs in the last two years, ultimately leading to its former chief executive David Brennan to be ousted and replaced by Roche’s Pascal Soriot in 2012.

It has also been hit by a number of patent losses in the same time period which has seen billions wiped off its balance sheet as generic competition increases. The effects felt by these losses are expected to continue for a number of years, and investors have been concerned that AZ’s pipeline is looking too dry for any real turn-around.

But speaking at the JP Morgan healthcare conference in the US, the company tried to allay these fears. “AstraZeneca’s late-stage pipeline now comprises 11 Phase III programmes, almost double the number of programmes a year ago, and 27 Phase II programmes,” it said.

It also pointed to its recent $4.3 billion (£2.9 billion) buyout of Bristol-Myers Squibb’s half of the diabetes business the pair developed together as a source for future growth.

But despite the rhetoric, some analysts were unimpressed. Savvas Neophytou from Panmure Gordon, said there was a sense of “déjà vu [. . .] in our view, management is stepping on to thin ice with the same sort of guidance already attempted – and failed – this decade by previous management.”

Sachin Jain and Graham Parry, at Bank of America Merrill Lynch, said that even if sales hit AstraZeneca’s new target, the company still had to worry about its overall profits. “We remain cautious on cost base progression,” they wrote in a note to clients.

But it was not all bad news for AZ. Alexandra Hauber, an analyst at UBS, said that acquisitions could account for some of the upgrade in estimates. “We have highlighted previously that building an innovative business takes time and investment, and hence we expect management to prioritise investment rather than maximising profitability in the short-term.”

Ben Adams

Related Content

NICE recommends Benralizumab for Rare Form of Vasculitis

The National Institute for Health and Care Excellence (NICE) has recommended AstraZeneca’s benralizumab (Fasenra) as …

NICE approves AstraZeneca’s dual immunotherapy for advanced liver cancer

AstraZeneca has received a positive recommendation from the National Institute for Health and Care Excellence …

Roche receives CE Mark for blood test to help rule out Alzheimer’s

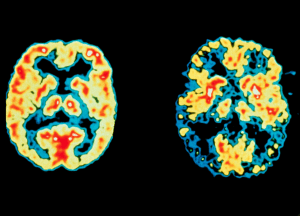

Roche has been granted CE Mark approval for its Elecsys pTau181 test, the first in …