Merck unveils $41 billion takeover of Schering-Plough

pharmafile | March 9, 2009 | News story | Sales and Marketing | MA, Merck

Merck is to acquire Schering-Plough for $41.1 billion, creating a new industry giant to challenge Pfizer in terms of its scale and annual sales.

The move unites the makers of cholesterol drugs Zetia and Vytorin, and creates a company with combined 2008 sales of $47bn, just behind the $48bn Pfizer earned last year.

The move is a break from tradition for Merck, which has for many years eschewed mergers and acquisitions, saying they often failed to generate value for shareholders.

But now Merck's Richard Clark and Schering-Plough's Fred Hassan have put together a merger plan which aims to generate cost savings of approximately $3.5bn annually from 2011.

Richard Clark will lead the combined company, with Merck shareholders owning a stake of about 68%.

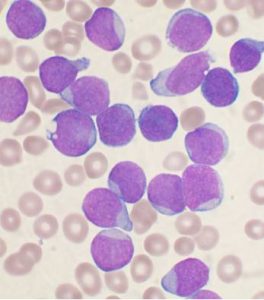

Merck has said the merger will create a more diverse portfolio across important therapeutic areas, including cardiovascular, respiratory, oncology, neuroscience, infectious disease, and immunology.

"We are creating a strong, global healthcare leader built for sustainable growth and success, said Clark.

"The combined company will benefit from a formidable research and development pipeline, a significantly broader portfolio of medicines and an expanded presence in key international markets, particularly in high-growth emerging markets. The efficiencies we gain will allow us to invest in strategic opportunities, while creating meaningful value for shareholders.

Fred Hassan, chairman and chief executive officer of Schering-Plough said: "We are joining forces with Merck, our long-term partner in our cholesterol joint venture, to create a dynamic new leader in the pharmaceutical industry.

"By harnessing the strengths of both companies, the combined entity will be well-positioned to further deliver on our shared goal of discovering new therapies for patients to help them live healthier, happier lives."

Company setbacks

This is the second mega-merger to be announced this year following Pfizer's $68bn acquisition of Wyeth in January.

The deal is set to double the number of medicines Merck has in phase III, bringing the total to 18.

The companies suffered setbacks last year when sales of Vytorin (ezetimibe and simvastatin) and Zetia (ezetimibe) fell dramatically after clinical trials suggested a possible association with increased cancer risk.

Consolidating the marketing for the two drugs will play a large part in predicted cost cuts, which are in addition to other ongoing money saving initiatives at the two companies.

Long-term data on the drugs' ability to prevent heart attacks is expected in 2011 or 2012.

Related Content

Merck to acquire Curon Biopharmaceutical’s B-Cell Depletion Therapy

Merck have announced that they have entered into an agreement with private biotechnology company Curon …

Merck and Daiichi Sankyo expand development and commericalisation agreement to include MK-6070

Daiichi Sankyo and Merck (known as MSD outside of the US and Canada) have announced …

CHMP gives positive opinion for Merck’s KEYTRUDA for unresectable or metastatic urothelial carcinoma

Merck (known as MSD outside of the US and Canada) has announced that its anti-PD-1 …