Superbugs in the supply chain

pharmafile | May 26, 2017 | News story | Medical Communications | Antibiotics, Changing Markets, China, IMAGE: Changing Markets, Superbugs

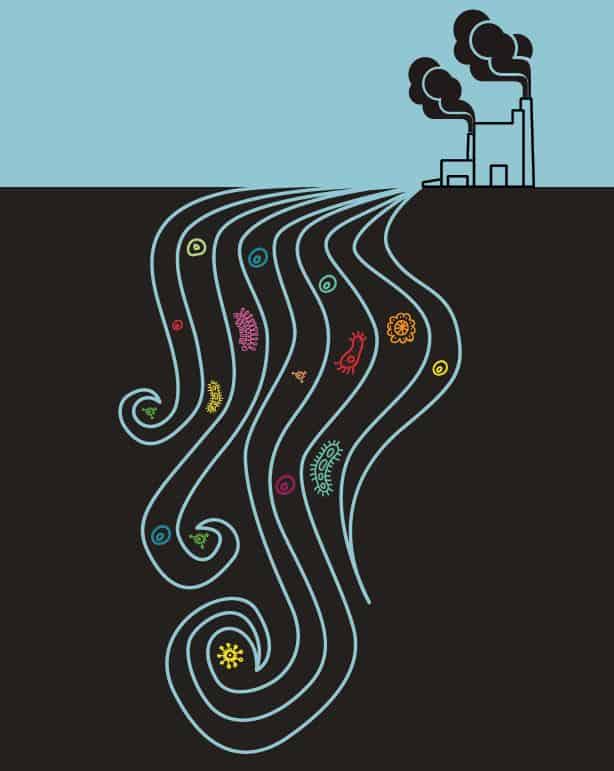

Bad Manufacturing Practices: Changing Markets examines China’s role in the antibiotics supply chain and the damaging pollution that results from the process.

Because pharmaceutical supply chains are so complex and opaque, mapping the journey of a pharmaceutical product from factory to pharmacy shelf is a challenging task. Measuring a drug’s environmental impact in particular is near impossible: U.S. and EU regulations in the shape of the GMP framework focus on drug safety but do not currently oblige companies to implement environmental safeguards during the drug manufacturing process. These – together with labour standards – depend exclusively on the host country and company which produced the drugs. Facilities in India and China which export to Western markets are hence regularly inspected for GMP compliance, but these inspections cannot sanction a factory for polluting practices, lack of waste water treatment or any other environmental problems. Even where environmental regulations are in place, the monitoring and enforcement of these rests exclusively with local authorities and is often found lacking. In the case of antibiotics production, pollution should be taken especially seriously as it has consequences which go far beyond national borders, in the form of AMR.

Although GMP inspections can only offer a partial snapshot of conditions at pharmaceutical plants, U.S. FDA and European medical agency reports frequently highlight serious manufacturing deficiencies at Chinese plants known to be supplying antibiotic ingredients to Indian, U.S., and European companies, which in itself presents major grounds for concern about the drugs we import.

China’s exports of pharmaceutical products and health supplements worldwide jumped 3 percent to $56 billion in 2015. Nearly 5,000 drug factories supply its domestic market, while more than 500 facilities are registered to sell to the United States. Official statistics show that EU imports of pharmaceuticals from China stood at $2.8 billion in 201574, but this figure does not account for Indian pharmaceutical imports made with Chinese raw materials and APIs. China is currently the world’s largest exporter of APIs, supplying over 50% of the global market and is the number one producer of penicillin salts worldwide. Over 80% of Chinese-made penicillin salts are exported to India, where they are processed into end products and exported onwards to other markets around the world. In recent years, Chinese companies have also sought to carve out a bigger share of the market for finished pills around the world.

With China playing such a pivotal role in global pharmaceutical supply chains, industry watchers keep a close eye on events within the country’s drug manufacturing sector. In a January 2016 analysis, the trade publication Pharma Compass identified the threat of antibiotic resistance emanating from China, coupled with Good Manufacturing Practice (GMP) compliance concerns at its manufacturing sites as the “two main issues threatening to disrupt the supply chain from China.”

Chinese manufacturers have repeatedly hit the headlines as a result of infringing GMP rules or owing to their dismal environmental performance. In June 2015, an investigation released by the campaigning organisation SumOfUs lifted the lid on a series of serious pollution incidents at antibiotics manufacturing sites in China. The report “Bad Medicine: How the pharmaceutical industry is contributing to the global rise of antibiotic-resistant superbugs” showed how major pharmaceutical companies including Pfizer, Teva and McKesson had sourced antibiotics from some of these sites, including:

- United Laboratories – TUL (Bayannur, Inner Mongolia and Chengdu, Sichuan Province)

- Shandong Lukang (Jining, Shandong Province)

- North China Pharmaceutical Company – NCPC (Shijiazhuang, Hebei Province)

- CSPC Pharmaceutical Group (Shijiazhuang, Hebei Province)

- Sinopharm WeiQida (Datong, Shanxi Province)

- Harbin Pharmaceutical Group (Harbin, Heilongjiang Province)

- Tonglian Group (Hulun Buir, Inner Mongolia)

- Inner Mongolia Changsheng Pharmaceutical Co. Ltd. – formerly CSPC Pharmaceutical Group’s Shiyao Zhongrun site (Hohhot, Inner Mongolia)

In 2015 alone, around 80 Chinese production sites were issued with a US FDA ‘Form 483’, which indicates that a company has committed manufacturing violations. These sites include factories supplying multinational pharmaceutical companies, and in some cases, joint ventures with U.S. and European companies.

For example, in late 2015, the Zhejiang Hisun Pharmaceutical Co. plant in Taizhou, Zhejiang Province, which supplies companies including Hospira (now owned by Pfizer), and Merck & Co., was hit with a U.S. import ban on its products, including antibiotics, following an FDA inspection which highlighted various manufacturing deficiencies. Zhejiang-Hisun is part of a $300 million joint venture with Pfizer (Hisun-Pfizer Pharmaceuticals Co., Ltd.), launched in September 2012 for the development, manufacture, and commercialization of a broad portfolio of products including pharmaceuticals to treat infectious disease.

In January 2016, a few months after the Zhejiang-Hisun ban, the US FDA banned U.S. imports of all antibiotics and drugs for human or animal use manufactured at the nearby Zhejiang Hisoar plant in Taizhou, again citing failure to comply with Good Manufacturing Practices. Zhejiang Hisoar, which built its reputation on the production of antibiotics such as Clindamycin, claims to supply drugs to Pfizer, BASF, Sanofi and Novartis. In fact, as reported by Bloomberg, a 2012 stock exchange filing shows that Hisoar has a 20-year agreement to supply antibiotic products to Pfizer Asia Manufacturing Pte Ltd., a subsidiary of the New York-based drugmaker. In addition to this, company documents show that in 2008, Zhejiang Hisoar entered into a “strategic production alliance” with German pharma giant Boehringer Ingelheim: in return for Boehringer’s expertise and technical support, it was agreed that Zhejiang Hisoar would invest in new production facilities specifically for Boehringer Ingelheim at its new site in Chuannan, Zhejiang Province.

EU inspectors have also cracked down on violations at Chinese pharmaceutical production sites. In 2015, The United Laboratories’ (TUL) plant in Zhuhai, Guangdong province, which claims to be the world’s largest manufacturer of the antibiotic Amoxicillin, received a statement of non-compliance from Romanian inspectors, who logged numerous problems, resulting in the withdrawal by the European Medicines Agency of Zhuhai United Laboratories’ certificate for the sale of

Amoxicillin sodium sterile, potassium clavulanate sterile and Amoxicillin sodium and potassium clavulanate sterile mix on the EU market. A restricted certificate was issued for the use of these products in “critical medicinal substances” in Romania, France and the United Kingdom.

TUL is one of China’s biggest antibiotics producers. Incorporated in the Cayman Islands, it has at least six production hubs dotted around China, including its plant in Zhuhai, which has seven production lines manufacturing thousands of tonnes of antibiotics every year. It also has plants in Inner Mongolia and Chengdu, Sichuan Province, which both featured in the SumOfUs “Bad Medicine” report. TUL’s factory in Inner Mongolia has repeatedly been spotlighted in the media and pursued by the local authorities for improper waste management, including the dumping of waste water into nearby Lake Wuliangsuhai. In 2008, the factory was ordered to suspend operations and install proper waste treatment after reports that the factory had secretly buried its waste in a 50-hectare pit. Effluent was also being discharged through irrigation ditches linking to the Yellow River.

According to TUL’s Annual Report 2015, the company received “incentive subsidies” of HK$29,986,000 to “encourage the operations of certain PRC [People’s Republic of China] subsidiaries for the development of environmental[ly] friendly manufacturing, pollution prevention, development on export sales and advanced technology” and in October 2015, Zhuhai United Laboratories was awarded the honorary title of “Clean Production Enterprise” of Guangdong Province. However, a site visit to Zhuhai United Laboratories in 2016 showed that the area surrounding the factory is far from clean.

Our investigators observed a “filthy scene with black, smelly and greasy water” in the area surrounding the plant. At the confluence of the Nanpai and Beipai rivers, which is close to where the factory stands, the surface of the water was covered with a layer of black sludge. The team observed a steaming sewage outlet discharging wastewater flowing with white foam, and could smell the “awful intense odour” from a distance. There are outlets placed every 10 metres for about 400to 500 metres along this section of the river. On the riverbank opposite the north-eastern corner of The United Laboratories plant, they saw white foam on the surface of the river, noting the water’s “indescribable” odour.

The Zhuhai United Laboratories plant is located in the Sanzao Science and Technology Industrial Zone, one of the biggest pharmaceutical manufacturing hubs in Guangdong Province. Local residents in Sanzao complain that the water quality remains filthy and smelly despite several attempts to regulate pollution in the area adjacent to the Beipei River.

According to the Sanzao municipal authorities, some plants are still discharging sewage into the river in secret. They and the local Environmental Protection Department have vowed to introduce stronger management, inspection, and enforcement to put a stop to the illegal sewage discharges. According to our sources, there is only one wastewater treatment plant in the area, which does not have the capacity to process the large volumes of effluent from all the plants in its catchment area and therefore serves “practically no function”.

Related Content

AstraZeneca and Sanofi’s Beyfortus approved in China

AstraZeneca and Sanofi have announced that Beyfortus (nirsevimab) has been approved in China for the …

First patient enrolled in Boan Biotech’s phase 3 trial for Nivolumab in China

Boan Biotech has announced that the first patient has been enrolled in its phase 3 …

AstraZeneca’s Calquence approved in China for chronic lymphocytic leukaemia treatment

AstraZeneca has announced that Calquence (acalabrutinib) has been approved in China for the treatment of …