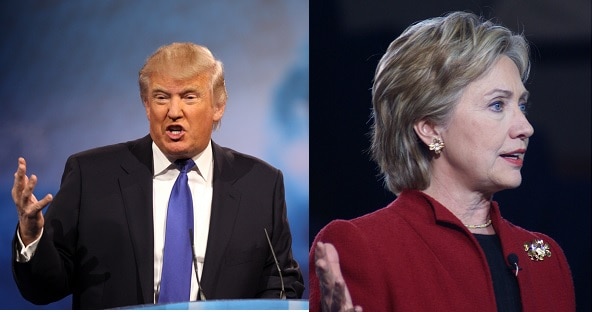

Trump and Clinton hit out at Pfizer over tax inversion plan

pharmafile | November 25, 2015 | News story | Sales and Marketing | Allergan, Pfizer

Politicians on both sides of the US spectrum have criticised Pfizer over its $160 billion buyout of Allergan and its intention to use the deal to relocate its tax domicile to Ireland, thereby depriving the US of significant revenues.

Analysts believe the so-called tax inversion will allow Pfizer to cut its tax bill by up to 8% from the 25% it currently pays, despite new legislation from the Treasure Department to tighten regulations on the practice, as the deal was structured to avoid this affecting it, with smaller Allergan technically buying its larger former rival.

Both Republicans and Democrats bemoaned the fact that the company was able to get away with the move.

Republican frontrunner Donald Trump told Business Insider “the fact that Pfizer is leaving our country with a tremendous loss of jobs is disgusting,” and “politicians should be ashamed,” while his Democrat counterpart Hilary Clinton was reported to have said “we cannot delay in cracking down on inversions that erode our tax base.”

Clinton added in a statement: “For too long, powerful corporations have exploited loopholes that allow them to hide earnings abroad to lower their taxes. Now Pfizer is trying to reduce its tax bill even further. This proposed merger, and so-called inversions by other companies, will leave US taxpayers holding the bag.”

Clinton’s rival for the Democratic candidacy, Bernie Sanders, also weighed in, maintaining his line that big pharma must be more closely regulated to avoid drug prices rising further. He said: “The Pfizer-Allergan merger would be a disaster for American consumers, who already pay the highest prices in the world for prescription drugs. It also would allow another major American corporation to hide its profits overseas.”

Sanders went as far as to say that the Obama administration has the power to halt the merger, and that it should exercise it.

Pfizer defended itself, however, calling the merger “a great deal for America”, as the combined companies now have 40,000 employees in the country. In an interview with CNBC shortly after the record-breaking tie-up was announced, CEO Ian Read said “it allows us to continue to sustain an investment of approximately $9 billion mainly spent in the United States.”

Read has also claimed that the 25% corporation tax rate it had previously been obliged to pay had force the compant to battle its rivals with “with one hand tied behind our back.”

“We’ve assessed the legal, regulatory and political landscape and are moving forward with our strategy to combine these two great companies for the benefit of the patients and to bring value to shareholders,” Read said during a conference call on Monday, following the merger announcement. “That is our obligation.”

Joel Levy

Related Content

EC approves Pfizer’s Emblaveo for multidrug-resistant infection treatment

Pfizer has announced that the European Commission (EC) has granted marketing authorisation for Emblaveo (aztreonam-avibactam) …

Pfizer’s Velsipity approved by EC for ulcerative colitis treatment

Pfizer has announced that the European Commission (EC) has granted marketing authorisation for Velsipity (etrasimod) …

EC approves Pfizer’s Elrexfio for relapsed and refractory multiple myeloma

Pfizer has announced that the European Commission (EC) has granted conditional marketing authorisation for Elrexfio …